The Role of Insurance Surveys in Marine Coverage

- Tom Crosby

- Oct 27

- 4 min read

When it comes to protecting your boat, understanding the insurance survey processes is essential. These surveys play a crucial role in marine coverage, helping to assess the condition and value of your vessel. This ensures you get the right insurance policy and avoid surprises later. In this post, I’ll walk you through what these processes involve, why they matter, and how to prepare for them effectively.

What Are Insurance Survey Processes?

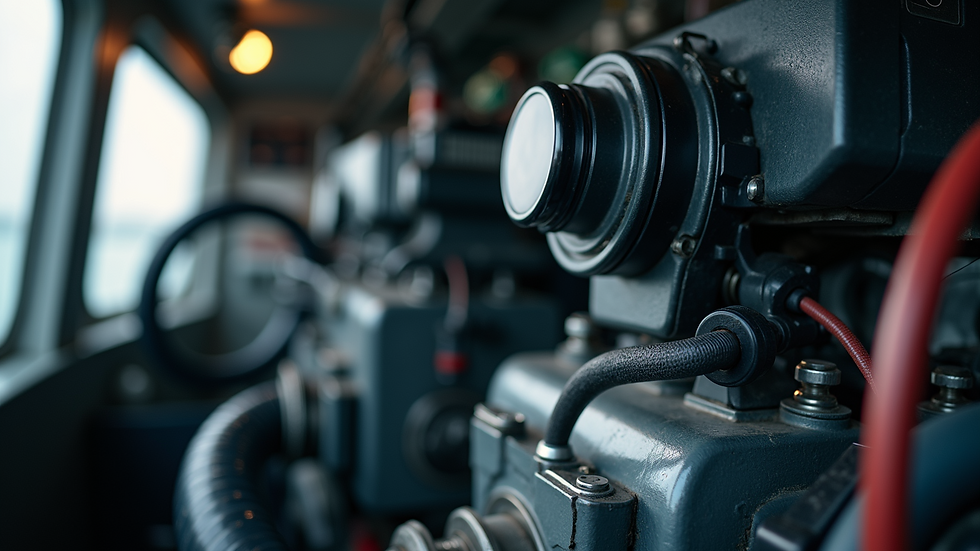

Insurance survey processes are a series of steps carried out by a qualified marine surveyor to evaluate a boat’s condition before issuing or renewing an insurance policy. The surveyor inspects the vessel thoroughly, checking everything from the hull and engine to safety equipment and navigation systems.

The goal is to identify any existing damage, potential risks, or maintenance issues that could affect the boat’s safety or value. This information helps insurers decide on coverage terms and premiums. It also gives boat owners peace of mind, knowing their vessel is properly assessed.

Here’s what typically happens during these processes:

Visual inspection of the hull, deck, and superstructure for cracks, corrosion, or damage.

Mechanical checks on the engine, steering, and electrical systems.

Safety equipment verification including life jackets, fire extinguishers, and distress signals.

Documentation review such as registration papers and previous survey reports.

Sea trial to test the boat’s performance and handling in water (if applicable).

These steps ensure a comprehensive evaluation that supports accurate insurance coverage.

Why Insurance Survey Processes Matter

Insurance survey processes are more than just a formality. They protect your investment and help avoid costly problems down the line. Here are some key reasons why these processes are important:

Accurate valuation: A detailed survey helps determine the true market value of your boat. This prevents underinsurance or overinsurance.

Risk identification: Surveyors spot hidden issues that could lead to accidents or expensive repairs.

Claims support: In case of damage or loss, having a recent survey report makes the claims process smoother and faster.

Compliance: Some insurers require a survey before providing coverage, especially for older or high-value vessels.

Safety assurance: Ensuring all safety equipment is present and functional protects everyone on board.

By understanding these benefits, you can appreciate why investing time and effort into the insurance survey processes is worthwhile.

How to Prepare for an Insurance Survey?

Preparing your boat for an insurance survey can make the process quicker and more effective. Here’s a simple step-by-step guide to help you get ready:

Clean your boat thoroughly

A clean boat allows the surveyor to inspect surfaces clearly. Remove dirt, algae, and clutter from the deck and engine area.

Gather all documentation

Collect registration papers, previous survey reports, maintenance records, and any receipts for recent repairs or upgrades.

Check safety equipment

Ensure life jackets, fire extinguishers, flares, and other safety gear are onboard, in good condition, and within expiry dates.

Perform basic maintenance

Top up fluids, check battery charge, and test navigation lights. Fix any minor issues you can handle before the survey.

Schedule the survey at a convenient time

Choose a day with good weather and calm waters if a sea trial is required. This helps the surveyor assess the boat’s performance accurately.

Be present during the survey

If possible, accompany the surveyor to answer questions and learn about any concerns firsthand.

Following these steps will help you get the most out of the insurance survey processes and avoid delays or additional costs.

What Happens After the Survey?

Once the surveyor completes the inspection, they prepare a detailed report. This report includes:

A summary of the boat’s condition

Any defects or areas needing repair

Recommendations for maintenance or upgrades

An estimated market value

Safety compliance status

You will receive a copy of this report, which you should review carefully. If the survey identifies issues, it’s wise to address them promptly. Fixing problems before finalising insurance can lower premiums and reduce the risk of future claims.

The insurer uses the survey report to decide on coverage terms. They may:

Approve the insurance as requested

Offer coverage with specific conditions or exclusions

Request repairs before issuing a policy

Decline coverage if the boat is deemed too risky

Understanding this process helps you manage expectations and plan your next steps.

How to Choose the Right Surveyor?

Selecting a qualified and experienced marine surveyor is key to a reliable insurance survey. Here are some tips to help you choose the right professional:

Check credentials: Look for surveyors accredited by recognised bodies or with relevant certifications.

Experience matters: Choose someone familiar with your type of boat and local conditions.

Read reviews: Feedback from other boat owners can provide insight into the surveyor’s professionalism and thoroughness.

Ask about services: Confirm what the survey includes and if a sea trial is part of the process.

Compare prices: Get quotes from multiple surveyors but avoid choosing solely based on cost.

A good surveyor will explain the process clearly, answer your questions, and provide a detailed, unbiased report.

For those in the Algarve and surrounding regions, UK Boat Surveyor is a trusted expert offering comprehensive insurance surveys tailored to your needs.

Taking Control of Your Marine Coverage

Understanding and engaging with the insurance survey processes puts you in control of your boat’s protection. These surveys are not just paperwork - they are a vital step in safeguarding your investment and ensuring your vessel is safe on the water.

By preparing well, choosing the right surveyor, and acting on the survey findings, you can secure the best insurance coverage possible. This approach helps avoid surprises and gives you confidence that your boat is properly valued and protected.

Remember, a thorough insurance survey today means smoother sailing tomorrow.

Comments